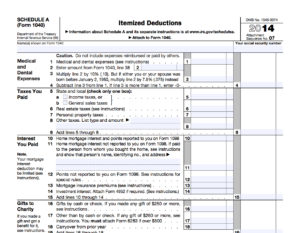

Itemized Tax Deductions

| Posted by: mhcpa | No Comments

Well folks, it’s that time again. Time to start scratching you head, wondering… Can this expense be an itemized tax deduction on my return? Given the season, Let’s review some of the more common deductions for those taxpayers who itemize on their Federal Income Tax Return.

The largest and most common itemized tax deductions are for your mortgage interest and real estate taxes on your residence. These deductions are available for both your principal residence and a second home. However, the portion of mortgage interest on cumulative loans in excess of $1,000,000 cannot be deducted.

Other taxes that are deductible include sales tax or state income tax. Also, personal property tax is deductible where the tax is based on value alone. Other interest that is deductible includes investment interest to the extent that you have investment income.

Another very common deduction is for those contributions or gifts you gave to organizations that are religious, charitable, educational, scientific, or literary in purpose. Contributions can be in cash, property or out-of-pocket expenses you paid to do volunteer work. If you drove to and from the volunteer work, you can deduct the actual cost of gas and oil, or $0.14 per mile.

Medical and dental expenses, including insurance premiums, are deductible to the extent that they exceed 10% of your Adjusted Gross Income (Form 1040, line 38). Premiums you pay for Medicare Part D, the supplemental part of Medicare insurance (Medicare B), and most premiums for qualified long-term care are included here.

Itemized tax deductions that do not fit in areas listed above are generally grouped in the category of Miscellaneous Itemized Deductions. The total of these expenses that exceed 2% of your Adjusted Gross Income are deductible. These include any job related expenses, including union dues, that are unreimbursed by your employer, tax preparation fees, custodial fees, investment fees, trust administration fees, certain legal & accounting fees and safe deposit box rent.

This is a general list and does not include many other items that may be deductible on your individual income tax return. If you have any questions regarding the deductibility of an item, please contact us.